What is it?

What is it?

Single Touch Payroll (STP) is an initiative from the ATO to encourage frequent digital salary reporting. It's a new simpler way to report your employees' payroll information to the Australian Taxation Office and keep your business compliant.

STP will be required for ALL employers by 1st July 2019, but don't worry, accounting software companies make it easy as possibly by automatically reporting to the ATO via their software. It is the biggest change to the way Australian businesses report to the ATO since the inception of the GST and Business Activity Statements.

Read our comprehensive STP guide below which includes;

- How does single touch payroll work?

- Is your payroll software ready? - Eye on Books can help

- STP guide for Xero

- STP guide for MYOB

- How will STP impact your business?

- Frequently Asked Questions

How does Single Touch Payroll work?

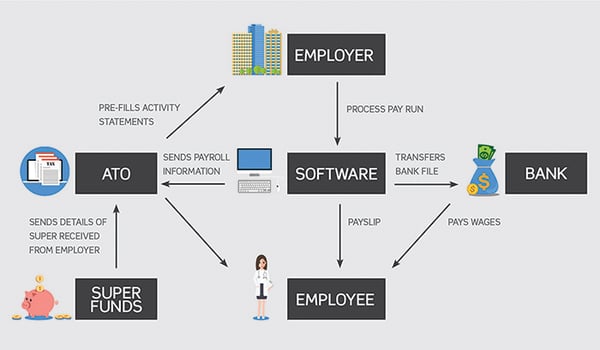

As you run your normal payroll, your tax and super details are sent from your accounting software to the ATO automatically.

- Pay your employees as normal (weekly, fortnightly or monthly) and give them a payslip

- Your STP-enabled payroll software sends a report directly to the ATO which includes required informaiton such as salaries and wages, PAYG withholding and super

- This page can help you setup your own accounting software in preperation for Single Touch Payroll, but if you need more help CONTACT US for our professional advice

Is YOUR payroll software ready for STP?

Are you a small business owner who manages the payroll side of your business manually? Are you using spreadsheets, or accounting software that won't be ready for STP? Software companies have come on board to offer a simple, cost effective solution from $10/month!

We can implement a payroll only STP solution for you from just $550

Our service includes;

- Setup business information in a Xero or MYOB payroll online account. The on-going subscription for this file is $10/month currently

- Confirm which Award your staff are employed under, their classificaiton and the rate they are being paid

- Add in any deductions or allowances that apply to your elmployees

- Setup the payroll structure and templates

- Add all your employee data

- Provide a 1 hour training session on how to process your payroll and file with the ATO (including 1 month of email payroll/STP support)

Get Started with Eye on Books now!

STP guide for Xero and MYOB

We've created a complete guide on handling not only setup of STP, but how to file your STP and fix errors in both Xero and MYOB. Follow our guides below to rest easy.

|

|

| Allowance types for Single Touch Payroll | |

How will STP impact your business?

Remember, Single Touch Payroll does not affect how or when you pay your employees - only how you report those payments. It also does NOT affect when your PAYG withholding payment is due.

STP reporting changes the way employers report information to the ATO about payments made in respect to employees. Here are the main alterations;

- Report employee's gross wage, tax and compulsory superannuation guarantee (SGC) to the ATO after each pay. This information is sent to the ATO from your STPO enabled payroll software

- Employers will no longer need to provide employees with a PAYG payment summary for payments made via STP (except for payments not made through STP for example, employee share schemes)

- Employees will be able to view their year-to-date payment information via their myGov account or they are able to request a copy of the information from the ATO.

- This will be a major change for employees, and we are expecting that it will take some time for employees nationwide to get used to not receiving a paper summary from their employer each year.

- SGC Liabilities which were previously provided to employees on their payslips will now be reported via STP

- The employee's complying superannuation fund will report to the ATO once the employer has paid the compulsory SGC liability to the employee's chosen or default fund

- THIS will be a major impact. Finally the ATO will know about business owners not doing the right thing in paying their employee superannuation. This is really the first time the ATO will have this information at it's finger tips, thereby helping create a level playing field between businesses paying their employee superannuation, and those that aren't

- Are you paying your employee superannuation on time?

Frequently asked STP Questions

How do I install it?

The good news is that if you have up to date accounting software, you barely need to do a thing. STP is now available to all businesses on Xero & MYOB. Follow the steps above to set up and opt in STP now. You can then use STP to file your employee pay and super info with the ATO.

Who should opt in? Me, my accountant or bookkeeper?

Whoever is intending to file STP reports should opt in. So if you are filing your own pay run, you should opt in. But if both you and your bookkeeper are going to file them, you can both opt in. NOTE: You must be an authorised contact with the ATO already when opting in to STP.

What information is sent with STP?

Payment, tax and super information will be reported to the ATO each time you pay your staff. But don’t worry, your accounting software has got it sorted for you. Both Xero & MYOB works out what payroll information needs to be filed, and sends it through to the ATO for you. For more details on what is reported, take a look at the ATO’s page on what you need to report.

Do I still need to submit a BAS?

Yes, businesses still need to submit a BAS.

Do FBT, ETP and RESC need to be reported via STP?

Yes. ETP (employment termination payments) and RESC (reportable employer super contributions) are reported when you process and file your pay runs. And FBT (fringe benefits tax) is reported when you finalise STP.

Do I need to do payment summaries any more?

Once you start STP, you won’t need to produce payment summaries or a payment summary annual report. Instead there’s a simple end-of-year process for finalising STP. This process just sends a confirmation that you have fully reported for the financial year and for each of your employees.

What happens if I make a mistake?

If you spot a mistake in a pay run that you’ve filed with STP, you can still make a correction. You have a few options here depending on the mistake you’ve found. You can either:

- revert the pay run, make your required changes, post and file

- complete an unscheduled pay run

- fix the mistake in time for your next pay run

For more information on how to deal with STP errors, check out our guide above

Will I need to file part year information if I don’t start STP at the beginning of the financial year?

No there’ll be no need for that. With STP, your accounting software files the financial year to date payroll information, which means that you only have to start filing information from when you opted into STP.

If you need ANY help with Single Touch Payroll for your business, contact us for professional advice, and rest easy!